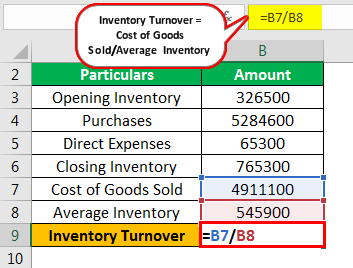

That’s $1,000 starting inventory minus $200 inventory at the end of the period. In the case of the giant stuffed bears, COGS is $800. To calculate COGS, subtract the value of your inventory at the end of the time period from the starting inventory value. Also leave out expenses such as marketing that don’t relate directly to manufacturing.Ĭost of goods sold is also called cost of sales. Fixed costs such as storage and other overhead aren’t included in the cost of goods sold. Variable costs include raw materials, manufacturing, and transport of goods to the warehouse. This includes variable costs that will go up or down depending on how much you sell. Cost of goods sold (COGS)Ĭost of goods sold is the cost of everything that goes into making your products. Only inventory that you have purchased will factor into your inventory turn rate. You don’t pre-purchase drop shipped products, so you don’t have to invest in these items.

If you drop ship some items, don’t count those items in your average inventory. Your average inventory includes only the items you have in stock in your warehouse. In this case, the average amount of inventory that you carried during the quarter is $600. You add beginning and ending stock levels and then divide by two. Your average inventory calculation would look like this: At the end of this period, you have $200 worth of stuffed bears left. You need to calculate your average stock before you can figure out your inventory turnover ratio.įor example, let’s say you started the quarter with $1,000 worth of giant stuffed bears in stock. Your average inventory is the average of your starting and ending stock levels for the period. It is the average amount of inventory carried during a certain time period. Average stockĪverage stock is also called average inventory. This can help you spot trends and assess the health of your business.īefore we dive into the inventory turnover formula, it’s helpful to define some inventory terms. In fact, you might want to look at past inventory turn rates and compare them to your current inventory turnover ratio. Calculating your stock turnover ratio will give you clear direction on how much to order. If this sounds confusing or vague, don’t worry it isn’t. That’s a sign that your sales are less than expected or that you ordered too much at once.

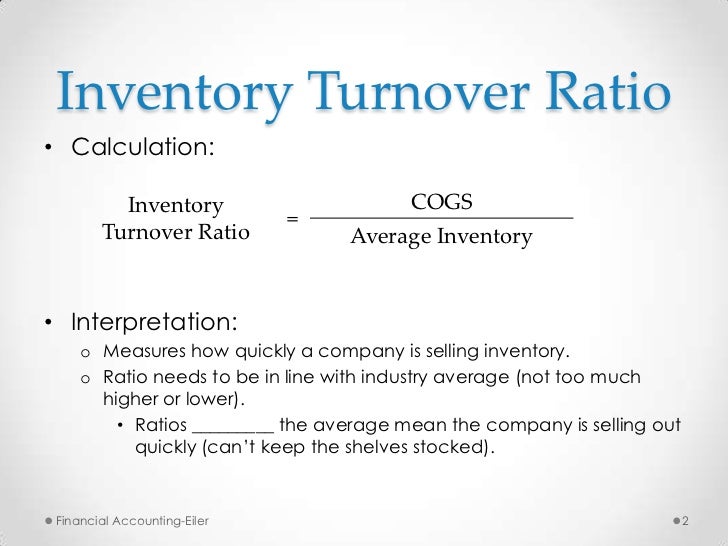

On the other hand, your stock might take a whole year to turn over. If your inventory turns over 12 times in a year, that indicates that you sold and replaced your entire stock every month. High turnover indicates that your products are selling well. The goal is to have high inventory turnover. The inventory turnover ratio is a measure of how quickly products sell once they are placed in stock. So, understanding your inventory turnover ratio can help you grow your business and increase your profits. That can reduce your ability to spend on marketing to grow your business. For example, you might have too much money tied up in inventory. And how well you manage your stock levels will make a difference to the long-term success of your company. However, it’s more important as an indicator of how you manage your inventory. Your inventory turnover rate does reflect whether or not a product is selling well.

0 kommentar(er)

0 kommentar(er)